Processor Whispers: About ups and downs

by Andreas Stiller

by Andreas Stiller

Is the PC market collapsing or is that not true at all and the ARM hype is on the retreat? In either case, the PC manufacturers have to reorientate themselves – Dell, for instance, went public 25 years ago and now intends to go private again – lots of movement in the IT scene.

Following the example of IBM, Apple also announced another record quarter, with sales of $54.5 billion and a net profit of $13.1 billion. A year ago, Apple managed to make the same profit with sales of only $46.3 billion, so the profit margin has declined a little. And also the decidedly overheated share price has finally returned to normal levels; currently it is at about $430, which is quite a bit below the all-time high of $705 from five months ago.

The largest portion of sales was generated by selling 47.8 million iPhones and 22.9 million iPads, of course. Macs, on the other hand, are on the wane: sales went down to 4.1 million units from 5.2 million units in the year-ago quarter – even though they are, according to Apple, the best personal computers in the world. For the Mac Pros at least, this claim seems highly doubtful; in Europe, sales of the outdated current generation have been stopped for now because of safety issues.

As reported by the IDC, the PC market as a whole has lost much less – 3.2 per cent – but already the term "post-PC era" is omnipresent. Traditional PC companies like Dell and Hewlett-Packard have to realign themselves. HP is still the leader in this market and was able to slightly extend its lead over Lenovo again in the Christmas quarter 2012. In Germany, however, Lenovo has meanwhile taken over the pole position in the PC business.

With the servers, things are looking up a little for HP again. The company has now definitely won the fight against Oracle: a Californian appeals court has rejected Oracle's appeal against the judgement that declared the discontinuation of Itanium support illegal. In April, HP intends to file a lawsuit for damages, probably a matter of a few billion dollars.

And HP has indeed taken losses, and big ones at that. Last summer it lost $8.8 billion and then again $6.9 billion in the autumn. However, these bad figures are a result not so much of the poorer Itanium and PC sales figures, but rather of the write-offs of the obviously over-priced acquisitions of EDS and Autonomy amounting to the astronomical total of $24 billion.

New Paths

The former HP CEO, Léo Apotheker, who was responsible for the Autonomy misstep, wanted to leave the problematic PC business, just like Carly Fiorina a few years before him. Mark Hurd, who reigned over HP in between, categorically refused any such move, just like the current CEO Meg Whitman, who, by the way, also refuses to sell off EDS and Autonomy.

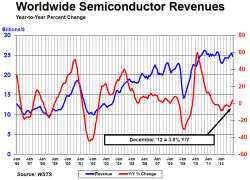

![]() The ups and downs of the semiconductor market. Blue: sales per month, red: difference to the previous year in per cent.

The ups and downs of the semiconductor market. Blue: sales per month, red: difference to the previous year in per cent.

Source: WSTS

To stay in keeping with this cyclical tradition, the next CEO will probably herald the departure from the PC market. Meanwhile, HP is getting rid of lots of staff, it's aiming to let go of almost 10 per cent of its personnel worldwide, around 29,000 employees. In Germany, HP's Enterprise Services in Rüsselsheim, which has 850 employees, is closing down – a former site of the huge loss-maker EDS.

Dell has chosen a different path: hefty investments instead of mass redundancies. The promising business model in this market, apparently, is to provide all-in-one solutions from a single source, locally as well as in the cloud – a model that Cisco introduced together with EMC² and VMware, with much ado, under the term "Unified Computing" about three years ago.

Now, Hewlett-Packard and IBM have established a massive counter-offensive, the former with "Converged Infrastructure" and the latter with "PureSystems". And now Dell also plans to play a more important role in this segment with its "Active System" and get rid of its discounter image within the server sector. Its path as a solution company began some years ago, with the acquisition of the iSCSI storage company Equallogic. Two years ago, however, Dell suffered a defeat by HP in the bidding contest for the sought-after storage specialist 3Par. But then, Dell's acquisition department got started in earnest. In the last two years, it has spent more than $12 billion, mostly on software companies.

In the last year alone, seven companies from the security, monitoring and management sector have been bought, among them Gale Technologies, a leading specialist for IT management, in November, and the data security company Credent in December. While Dell's investment activities generated some attention, a lot more attention was attracted by the company's founder and major shareholder Michael Dell announcing that his company will follow the tried-and-tested example of Baron Münchhausen by pulling itself out of the mess by its own hair. Well, to be precise, he will accept a little help from Microsoft and other investors for his ambitious project: to buy out the shareholders and then, without having to consider shareholders or the stock exchange supervision, get the company back on track again. Together with his sponsors, Dell plans to invest $24.4 billion to this end, $2 billion of which would come from Microsoft. Maybe we will soon see Dell smartphones too – whether with Intel or ARM processors, who knows?

ARM is doing well anyway. Thanks to sparkling licensing revenues, the British design company was able to increase its sales and profits by 18 and 28 per cent respectively – although the current quarterly profit of £42.5 million is peanuts compared to the figures from the previously mentioned companies. But in spite of ARM's growth, the microprocessor market is struggling, along with the whole semiconductor business. According to the numbers from the World Semiconductor Trade Statistics, in 2012, the worldwide sales of chips fell by 2.7 per cent, compared to 2011, to $291.6 billion. The largest segment in this market is logic ICs, which, at almost $82 billion, has hardly undergone any change. It's the microprocessors ($60 billion of sales) and storage ($57 billion) that are mostly responsible for the loss. As for NAND flash, the market analysts are divided, WSTS reports growth, IHS iSupply a significant decline.

The IDC says that PC microprocessors make up about two-thirds of the microprocessor market. Here, the analysts see a small silver lining, with a sales growth forecast of 1.6 per cent in this year and 3.4 per cent in each of the following years until 2016. Whether ARM will become important in the server and notebook market in the future? The IDC is sceptical and projects a puny market share of slightly above 3 per cent for 2016.

(djwm)

![Kernel Log: Coming in 3.10 (Part 3) [--] Infrastructure](/imgs/43/1/0/4/2/6/7/2/comingin310_4_kicker-4977194bfb0de0d7.png)

![Kernel Log: Coming in 3.10 (Part 3) [--] Infrastructure](/imgs/43/1/0/4/2/3/2/3/comingin310_3_kicker-151cd7b9e9660f05.png)